Project Background

This project focuses on the creation of a digital banking app paired with a financial management experience (FMA) to acquire new customers and increase Amar Bank's third party funding.

As the Product Designer, I worked across two major streams:

1. Designing the banking onboarding flow (account creation, KYC)

2. Providing design directions to tailor a white-label FMA app to fit Indonesian behavior.

Role: Product Designer

Scope: UX Strategy, Visual Design

Time: 3 months

Background Context

Amar Bank, an Indonesian bank widely known for their digital lending product (Tunaiku) wanted to build a saving product to strengthen its funding and brand relevance.

To increase the value proposition, they introduced FMA (Financial Management App) as a hook that entices customer to open a new saving account. This feature also provides spending insights and guides customer to top up their savings in order to achieve their goals.

Delivery Constraints

Approach

Research

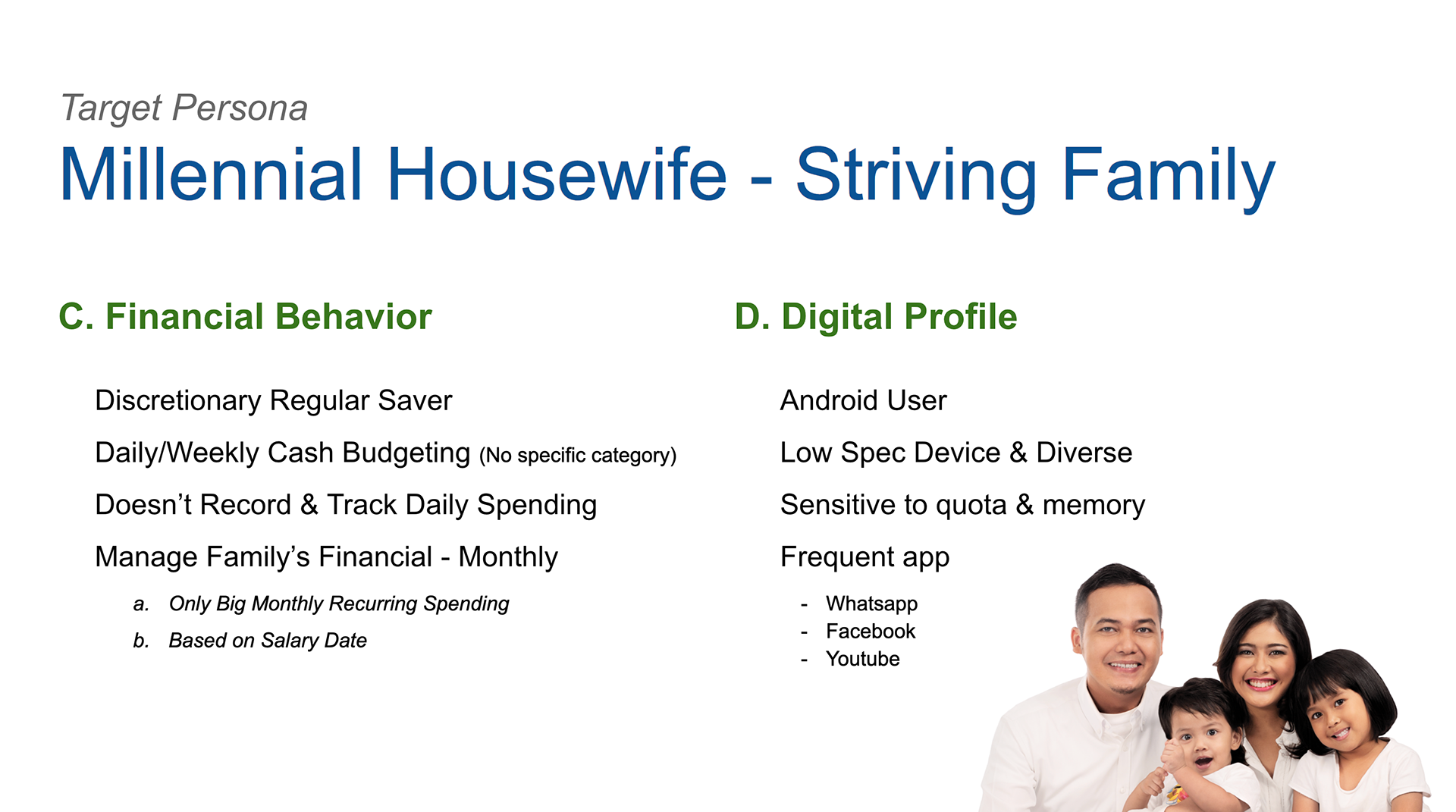

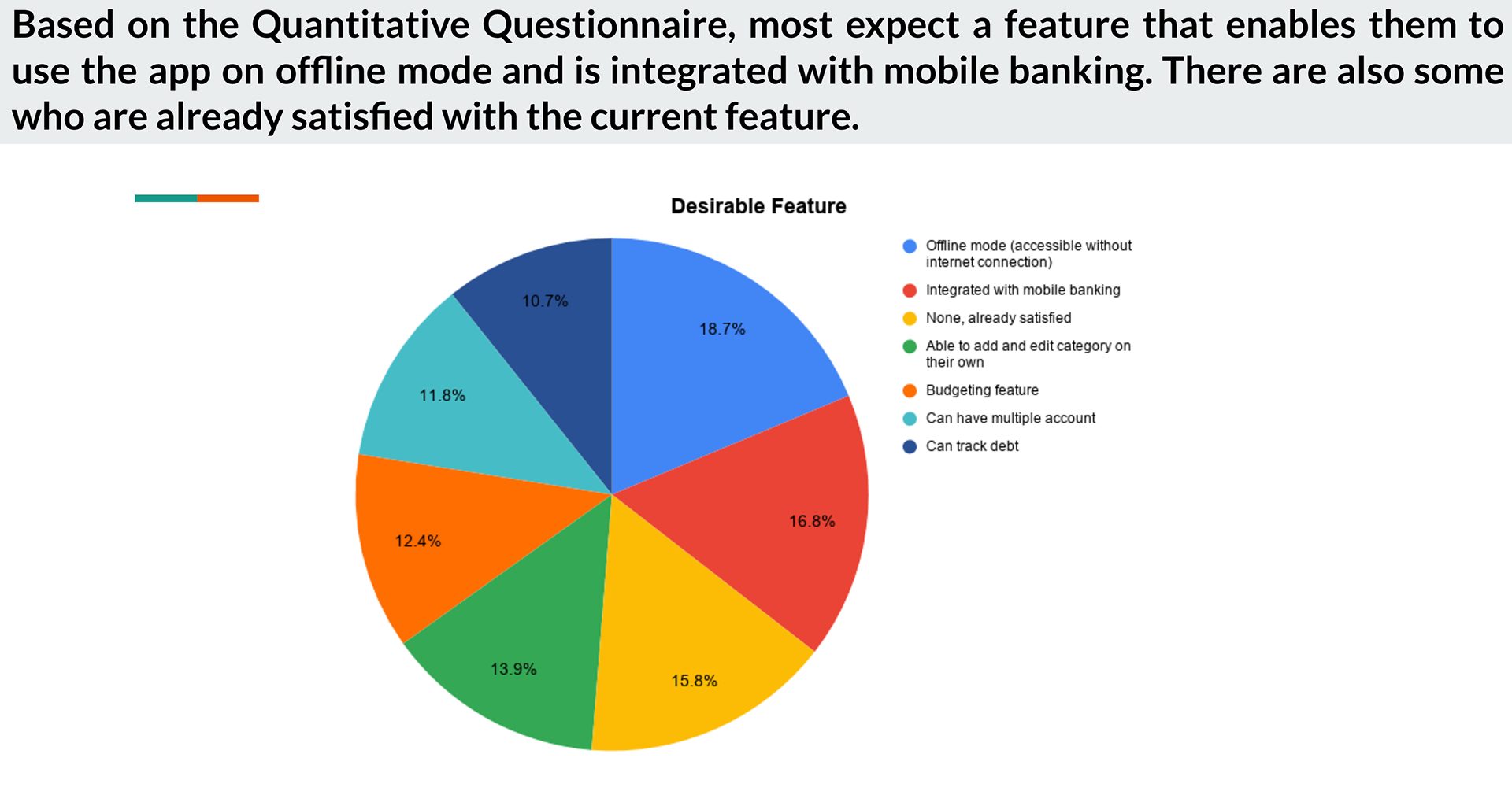

Our UX researcher took a deep dive to gain a better understanding on Indonesian financial literacy and behavior patterns. The goal is to identify the right approach for localization and product positioning.

The insights revealed that our early adopter, urban millennials, want a seamless banking experience that allows them to transact easily across different payment methods.

Given their low financial literacy, they prefer a simple method to evaluate their financial health. This tells us that we need to simplify FMA and focusing on financial health monitoring, instead of wealth building.

Design Strategy

The insights above are translated to how we craft our user experience – through branding, visual, and user journey.

Use the same visual language to create a cohesive, consistent user experience across all touch points

I created a temporary design system derived from Moven's app and Amar Bank's branding, emphasizing on similar color scheme and typography. However, our team also worked with a branding agency (Biro) to craft the long term branding strategy and visual language for future iterations.

Phase 1.0 Visual Language

Phase 2.0 Visual Language

Craft an approachable brand persona and compelling narrative tailored to our key demographics

I advised Biro to craft a brand persona that evokes the image of a trusted advisor who's reliable yet approachable. This is to demystify Indonesian millennials' fear and intimidating image of financial products.

Initial Brand Direction

Final Brand Concept

Localization through cultural and accessibility awareness

We made the FMA more relevant to Indonesians by taking into consideration their mental models, transactional behavior and technical constraints:

• Translate the fraction of thousand and millions of rupiah into typical abbreviations.

• Increase color contrast to increase readability and accessibility – critical, given the common technical constraints that Indonesian' mobile devices usage presents.

• Removal of advanced analytics and only maintain insights that are relevant to building healthy spending habits.

Create a seamless onboarding journey and a reliable support system

As our prototype focuses on account creation and KYC (no transaction features), we need to win customer's trust by providing them:

• a frictionless onboarding flow that's also connected to card delivery process (showing the legitimacy of our banking product);

• and a support system with a robust help center and access to our call center that answers their concerns and needs.

Architecture

The scheme below shows the relationship between the products – Senyumku digital banking app and Moven's financial management app.

Once users register, they can also access FAQ page to find information to common questions and contact details to Amar Bank's customer service center. This enables them to get support while waiting for their bank account opening.

Key Flows

Registration – Account Verification Based on Contact Number

We utilized ID verification in the first step of registration to check the validity of user's contact number and to cross-check with Amar Bank's customer database to see if they are a registered Amar Bank customer. If they are, user can jump straight into the “Debit Card Delivery Address” flow.

Eligibility Form – Lead Quality Assessment Before Account Creation

We streamlined the registration process by assessing user's eligibility and risk profile (based on their address, occupation, source of income). If eligible, user can proceed to the card delivery address section.

Card Delivery Address – Tailoring Steps to User's Mental Model

We pre-filled the card delivery address using user's residential address. This choice is intentionally done based on common user behavior pattern identified in Tunaiku.

However, we added a primer step to introduce bank card to prevent users from mistaking the bank card as contract.

KYC – Leverage OCR and Live Check-in to Streamline Process

We streamlined the KYC process by:

• automating ID data collection via ID card photo submission

• verifying user's identity through a live call

If all of their data is valid, then within 3 business days, the bank account is created and user will be onboarded.

Help Center – Support Customer at any Stage

We created a Help Center section to answer common questions during account opening and KYC process. To improve content search-ability, information is grouped based on topics, and we provide auto-suggestion on the search field.

Visual Examples

Below are some of the mockups created for the account creation flow and Help Center. Given that Help Center is hosted on the same website as Tunaiku, we had to rebrand it as "Tunaiku's Savings Account" to place it as part of Tunaiku's ecosystem. This would be corrected in the future phase (once Senyumku has its own website).

Outcome

The launch of this product led to business outcomes such as:

Increase of third-party funding and retail customers acquisition

This product allows Amar Bank to acquire new customers more quickly, which gave a fresh injection of funding to the retail lending as well.

A shift of Indonesian customers' brand perception of Amar Bank – from lending to a more holistic financial service provider.

As Senyumku's marketing rolled out to introduce this product, there was a growing interest in Indonesian millennials to open new savings accounts in Amar Bank. However, it would require more development and engagement strategies to retain them.

Key Learnings

Navigating cross-regional alignments and fragmented product development

• I learned to identify the constraints of each parties and made pragmatic decisions based on the highest priority of this project: delivering a functional prototype that meets industry regulation and operational requirements.

• This requires ruthless prioritization – knowing which features and design decisions that can be included in the scope, and balancing both user and business goals carefully – to deliver target on time.

Thinking products in a wider ecosystem

• This is the first time I learned how a product can be built on top of another – in order to attract new customers. Despite the challenge it presents, this product ecosystem helped me to think design and products in a more systemic manner.