Project Background

This project aimed to replace manual trading workflows with an integrated web system. The solution would centralize order instructions, track execution in real time, and ensure synchronization between the investment and dealing teams.

Role: Project Manager, Product Designer

Scope: Project Management, UX Strategy, Visual Design

Time: 3 months

Context Background

Henan Asset Management is an investment management firm that manages portfolios across stocks, bonds, and deposits. Despite the regulatory sensitivity of their operations, the order management process was very manual.

Problem

The existing bonds trading workflow suffers from several problems:

Goals

To solve those operational problems, the Order Management system (OMS) must provide a scalable, transparent real-time monitoring and regulatory compliance.

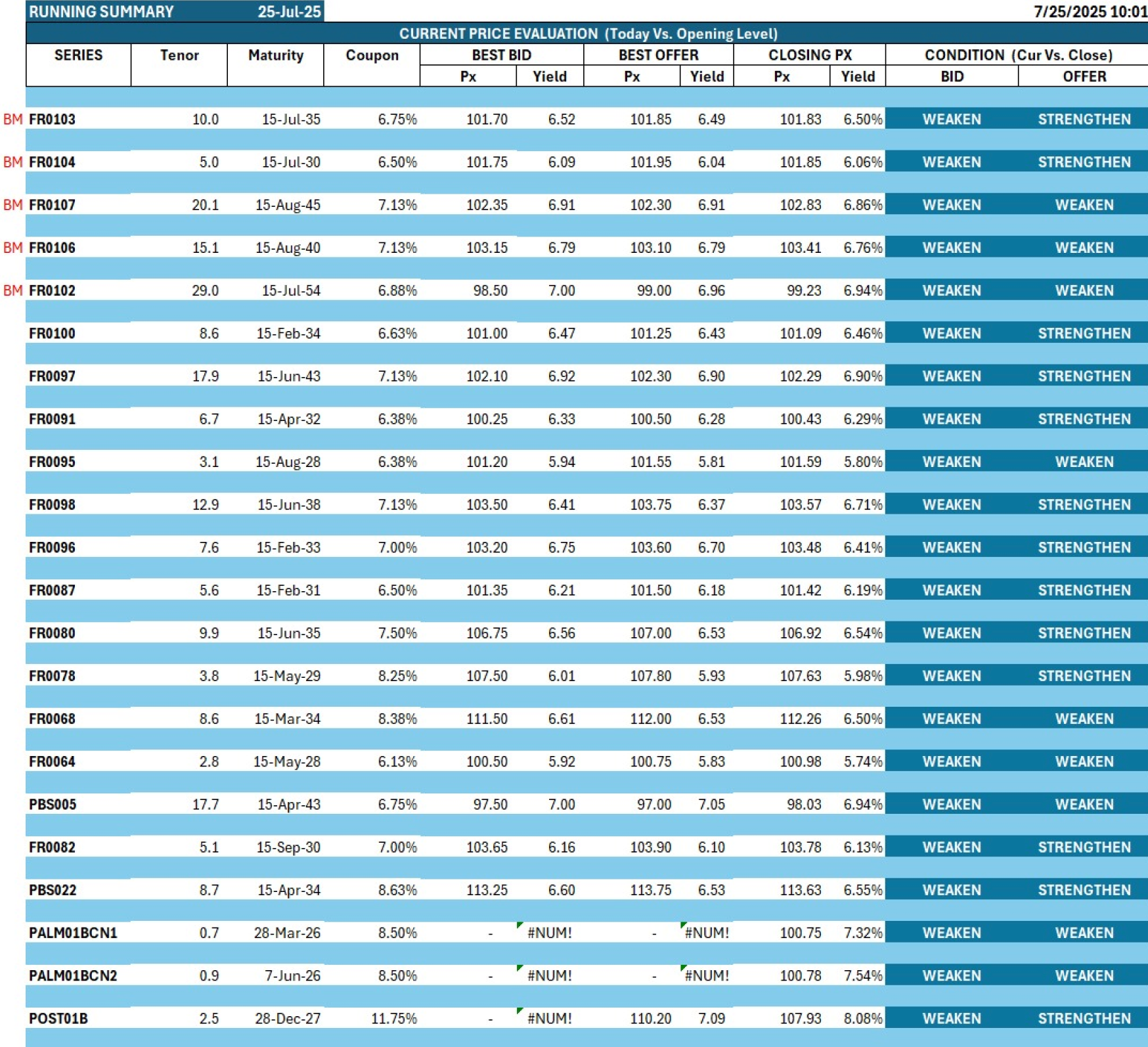

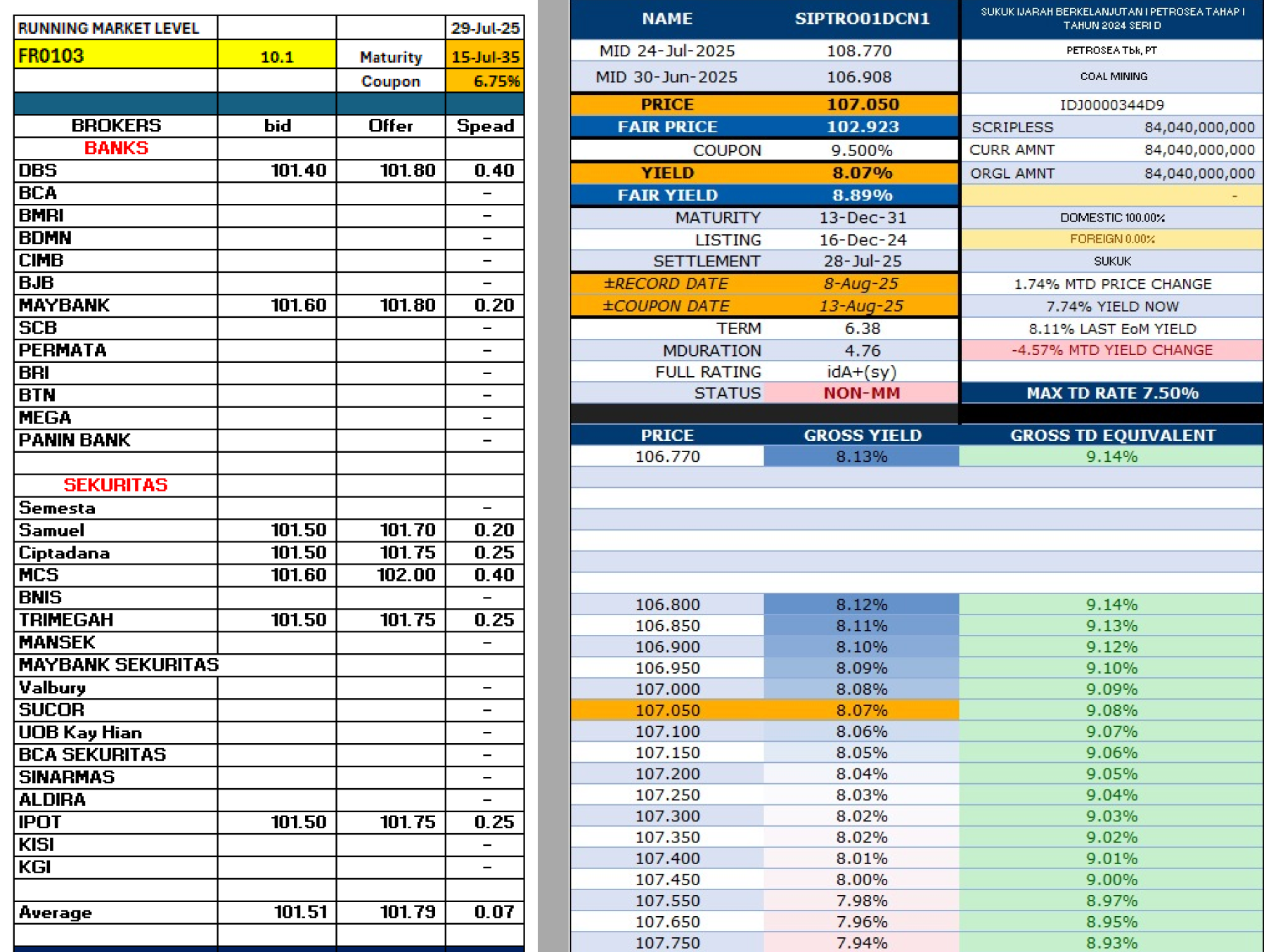

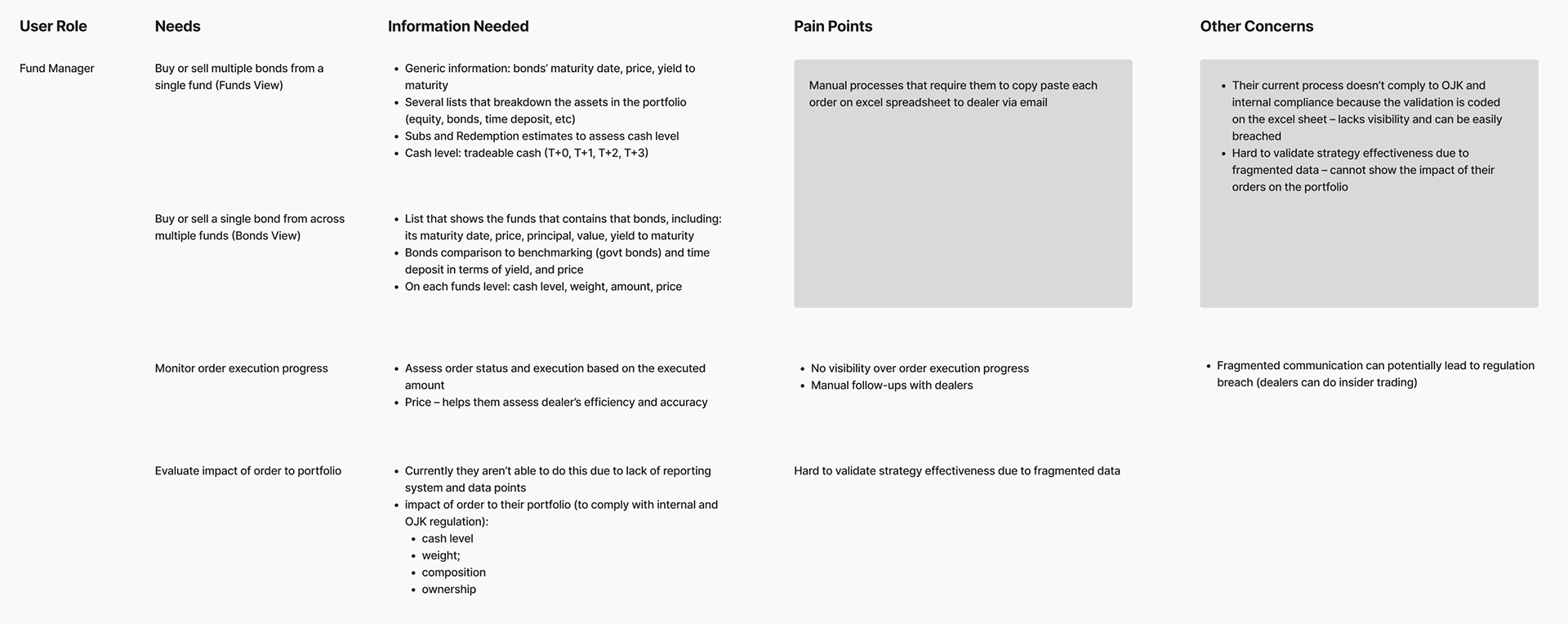

Stakeholders Mapping & Workflow Analysis

I began the process by conducting stakeholders interview to understand their scope of responsibilities, needs and identify their pain points in the current workflow.

The goal of this process is to map out the new capabilities needed and design new flows that solve the current pain points.

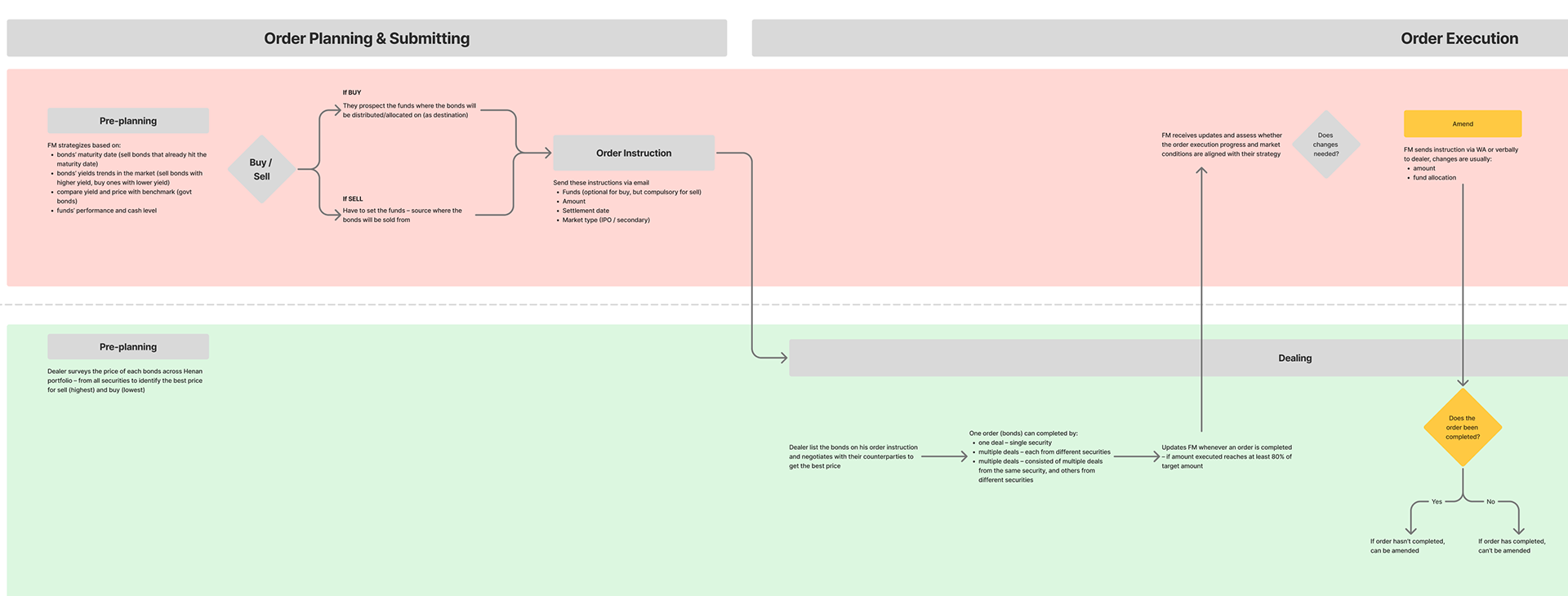

Workflow Redesign

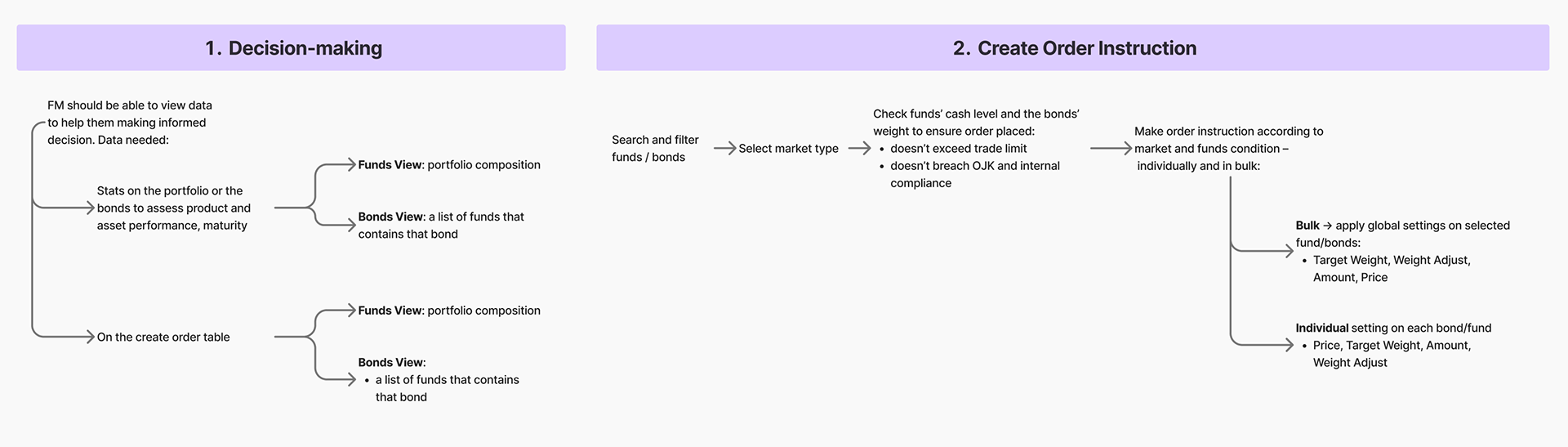

Order Creation Flow (Fund Manager)

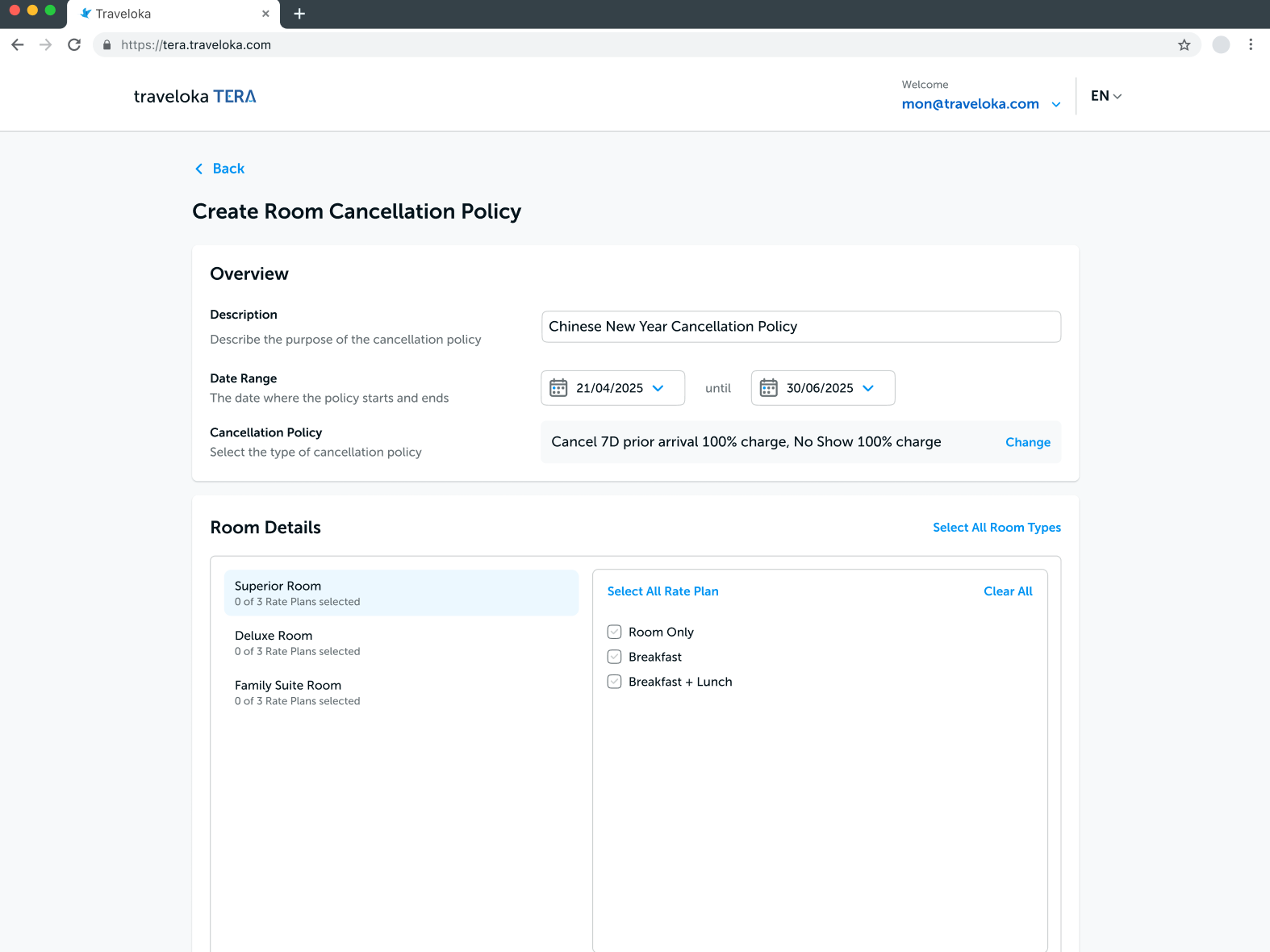

To comply with regulatory needs, order creation requires Fund Manager to set:

• the bond price;

• and fund for the destination where bonds will be placed (buy order), or source where the bonds will be sold from (sell order)

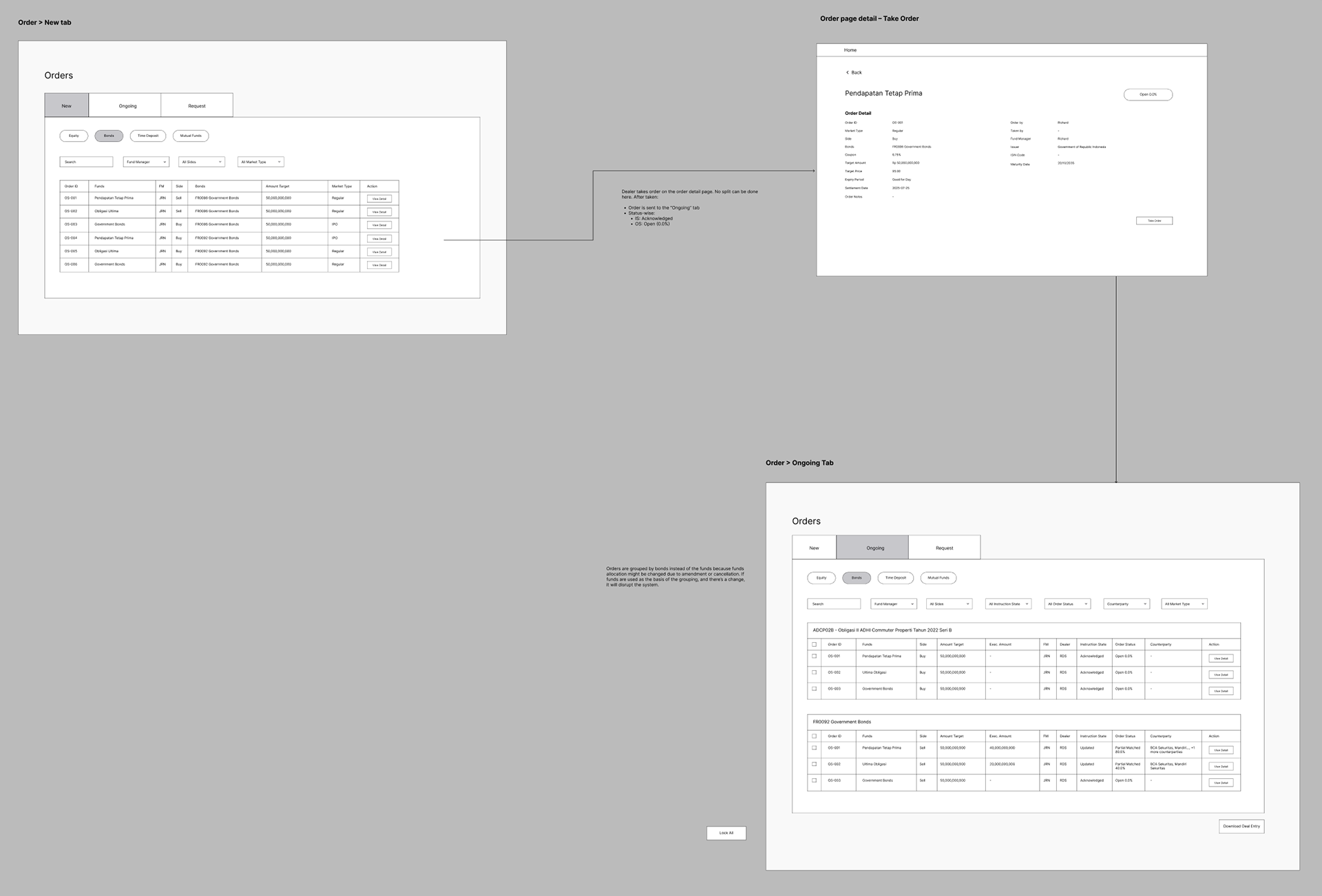

Order can be done from two entry points:

• Funds view: to place multiple orders of different bonds within 1 fund;

• Bonds view: to place multiple orders of a particular bond across different funds

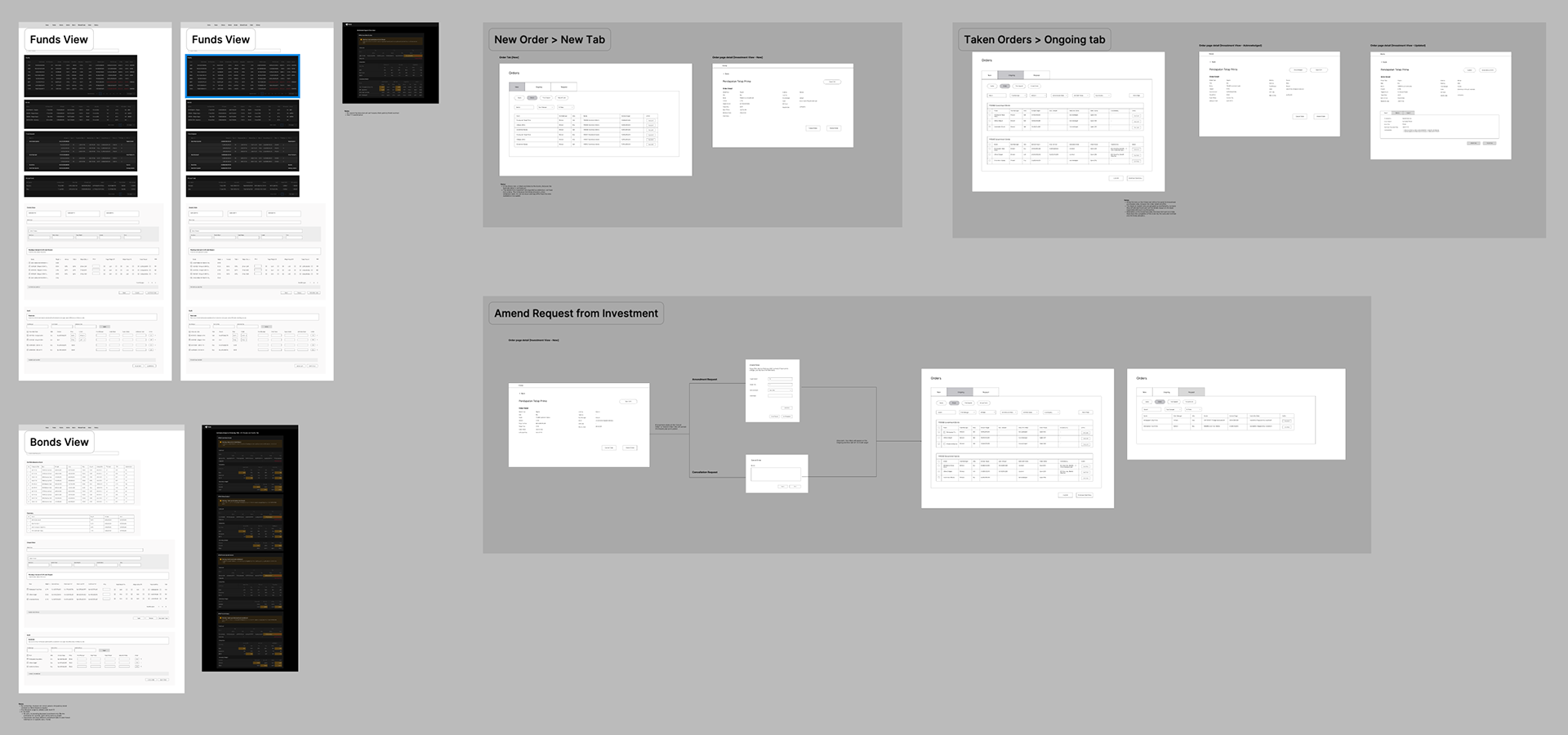

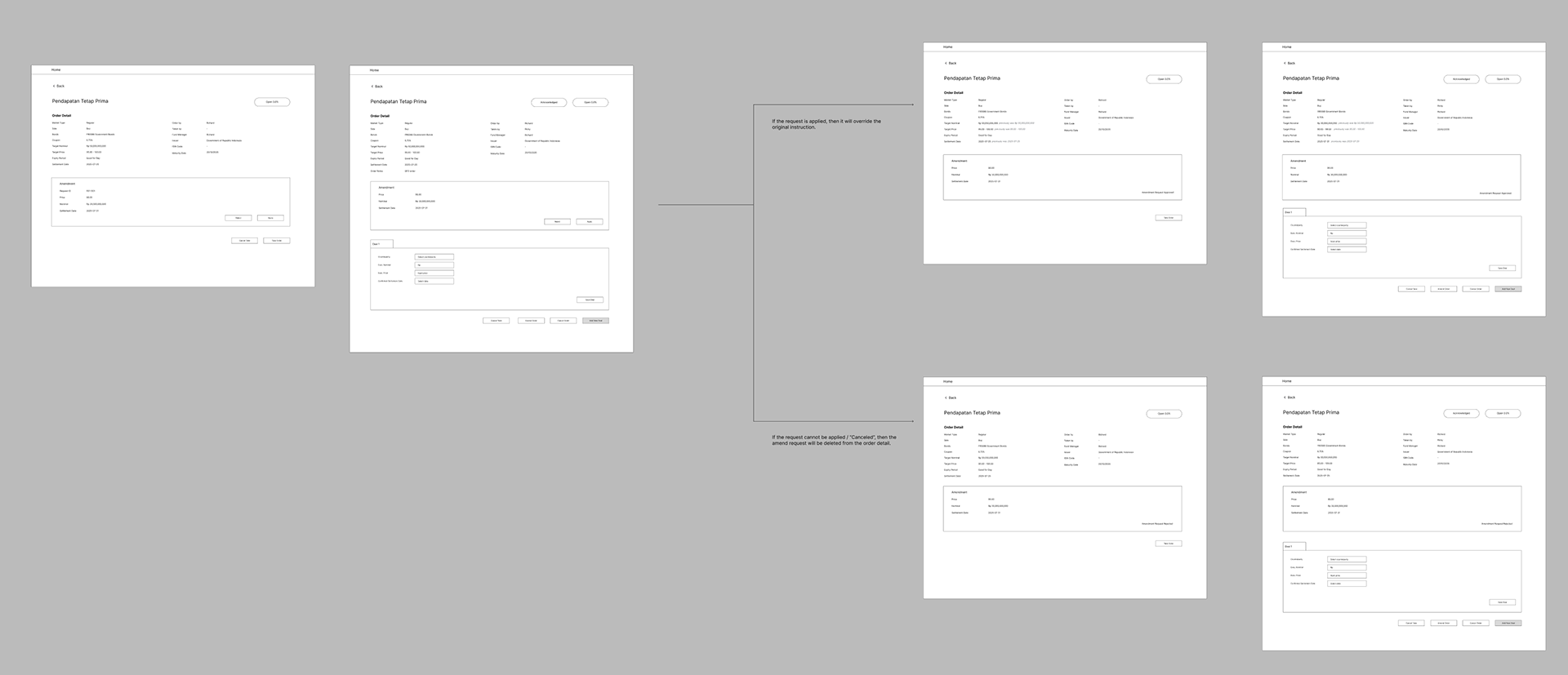

Order Execution Flow (Dealer)

The new flow combines dealer's current practice and a few new ones to systemize the process. This enables us to establish order lifecyle (mapping the relationship between user action and order status).

Order Lifecycle & Status

Order Status Transition

We invented two types of status to track the progress of their order. Both are needed because order progress is determined by user activity and deal execution.

• Order Status: indicated based on the comparison between the executed amount (across all deals) and order's target amount

• Instruction State: indicated based on user actions (e.g order is taken by dealer – acknowledged, a deal is created – updated, etc)

Order Lifecycle Logic

Order completion is treated differently based on its expiry period:

•GFD (good-for-day): order expires by end of day (market closing hour)

•GTC (good-til-call): order stays active for the next 30 days or till it's completed

I created simulations for both scenarios (GFD and GTC) to help engineers and QAs understand the logic. See below for one of the examples:

Architecture and Interaction Model

Product Architecture

The scheme below shows the structure and relationship between the modules, where the access and capabilities available on each module is tailored to each user role.

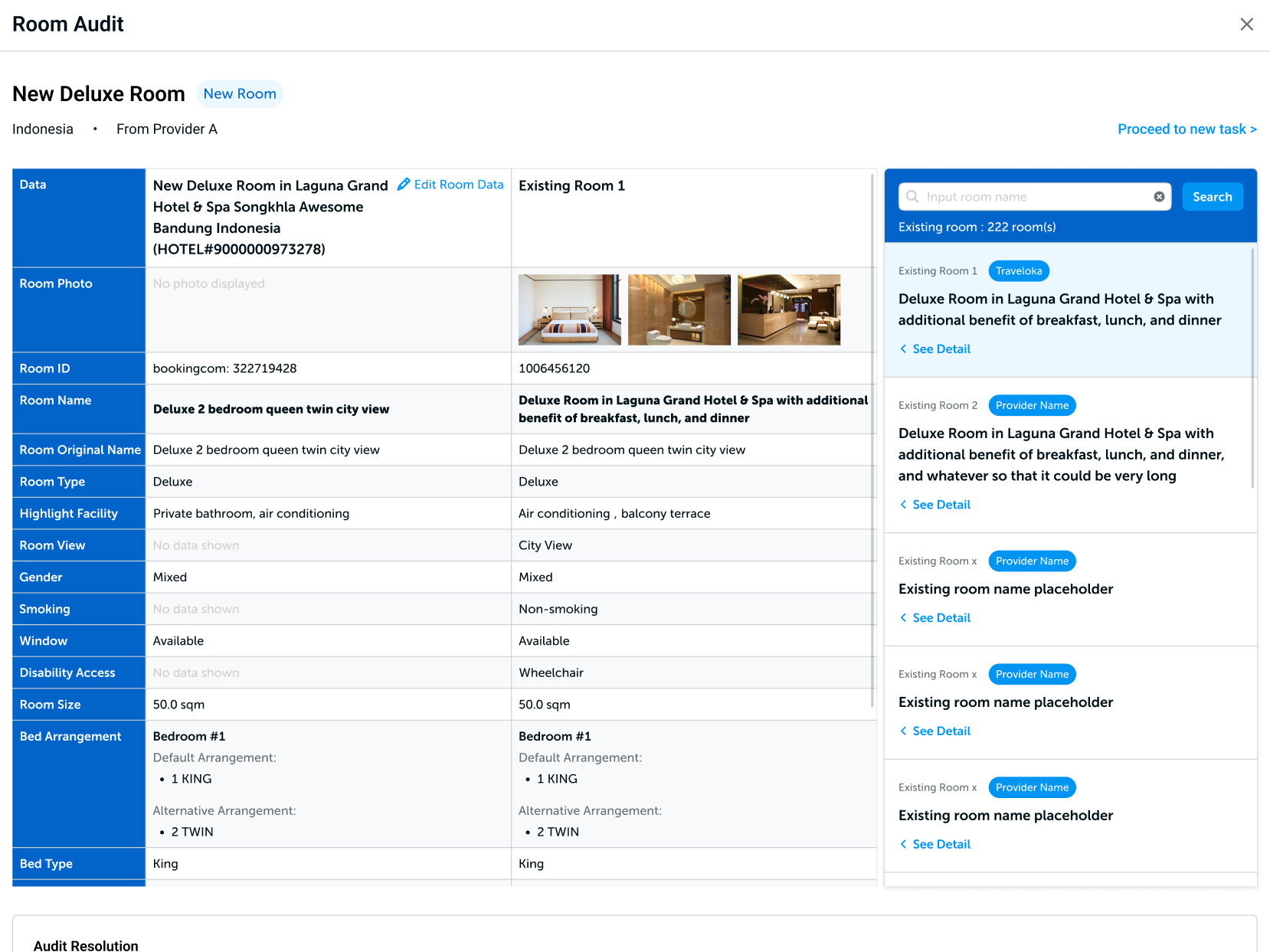

Order Tracking Module

I devised a system where orders are segregated on three tabs, where each tab lists orders based on its instruction state:

• New: orders that haven't been taken by dealer

• Ongoing: taken orders – ready to be executed by dealer

• Request: orders where fund managers placed amendment or cancellation request on

On the Ongoing tab, orders are separated by asset class (equity, bonds, time deposit) to keep access tailored to each fund manager's scope of responsibilities.

On the order table, the orders are consolidated by bonds, where each group can contain multiple deals (nested).

Concept Validation

Before finalizing the design, I reviewed the user flows with all stakeholders to validate the solution and assess its technical feasibility.

This process went smoothly as the majority of the requirements and flows had been aligned beforehand. Therefore, once the PRD and high fidelity designs are ready, they can be translated for development and testing.

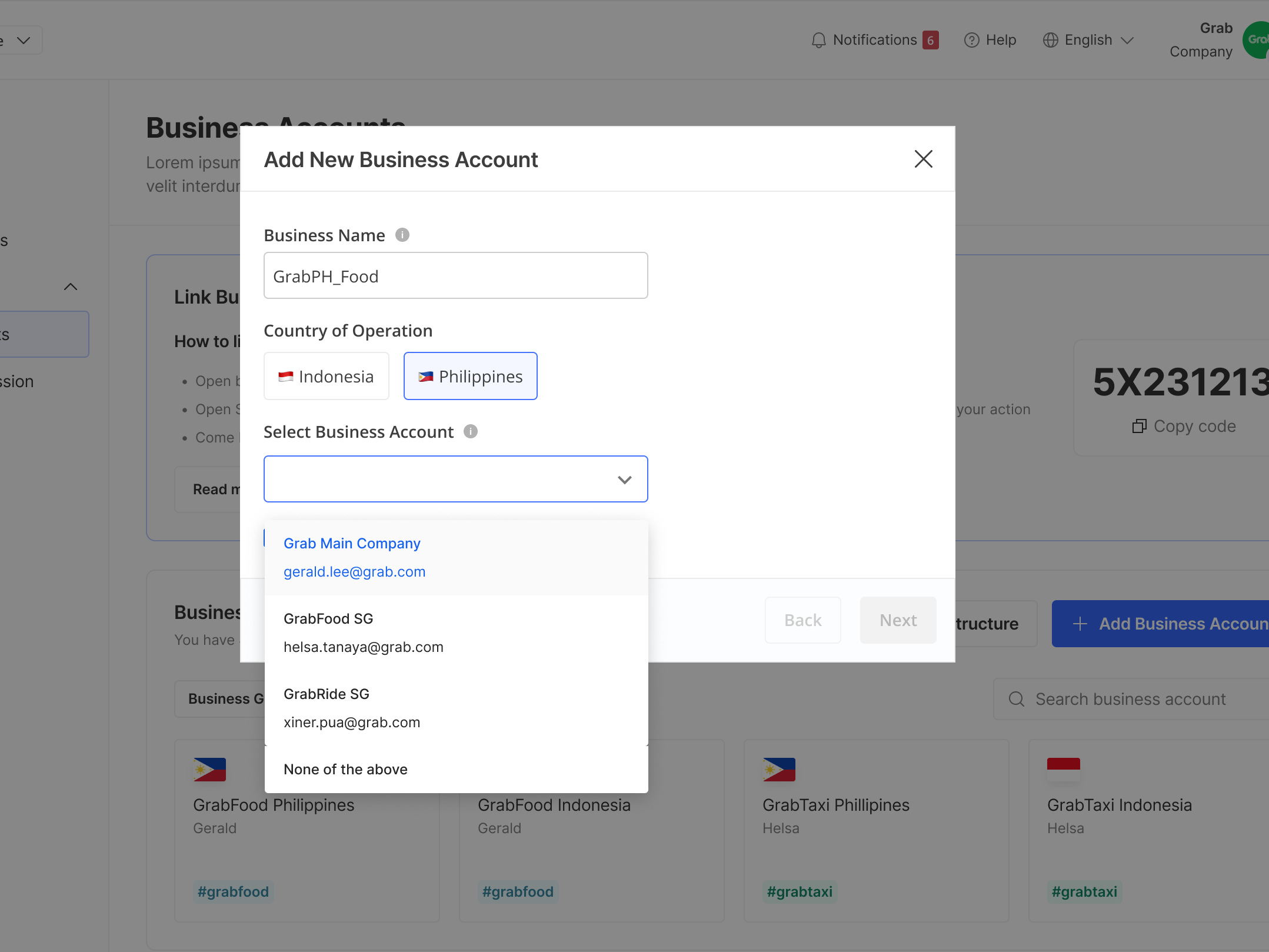

Unified Dashboard with Role-Based View and Capabilities

The dashboard can be accessed by both fund manager and dealer to ensure orders and updates are trackable in a single platform. However, access and capabilities provided are tailored to each user role.

Granular, Robust Order Creation Module

Fund manager can create order instruction from both Funds View and Bonds View page. On both pages, there's global settings and individual parameters on each row to enable them to apply and create orders on bulk, or manually through granular settings.

Layered Validations to Maintain Order Accuracy and Compliance

Provide validation on multiple touch points to prevent user from exceeding cash limit or breaching OJK regulations and internal policies. They can also view the impact of their order instructions through preview.

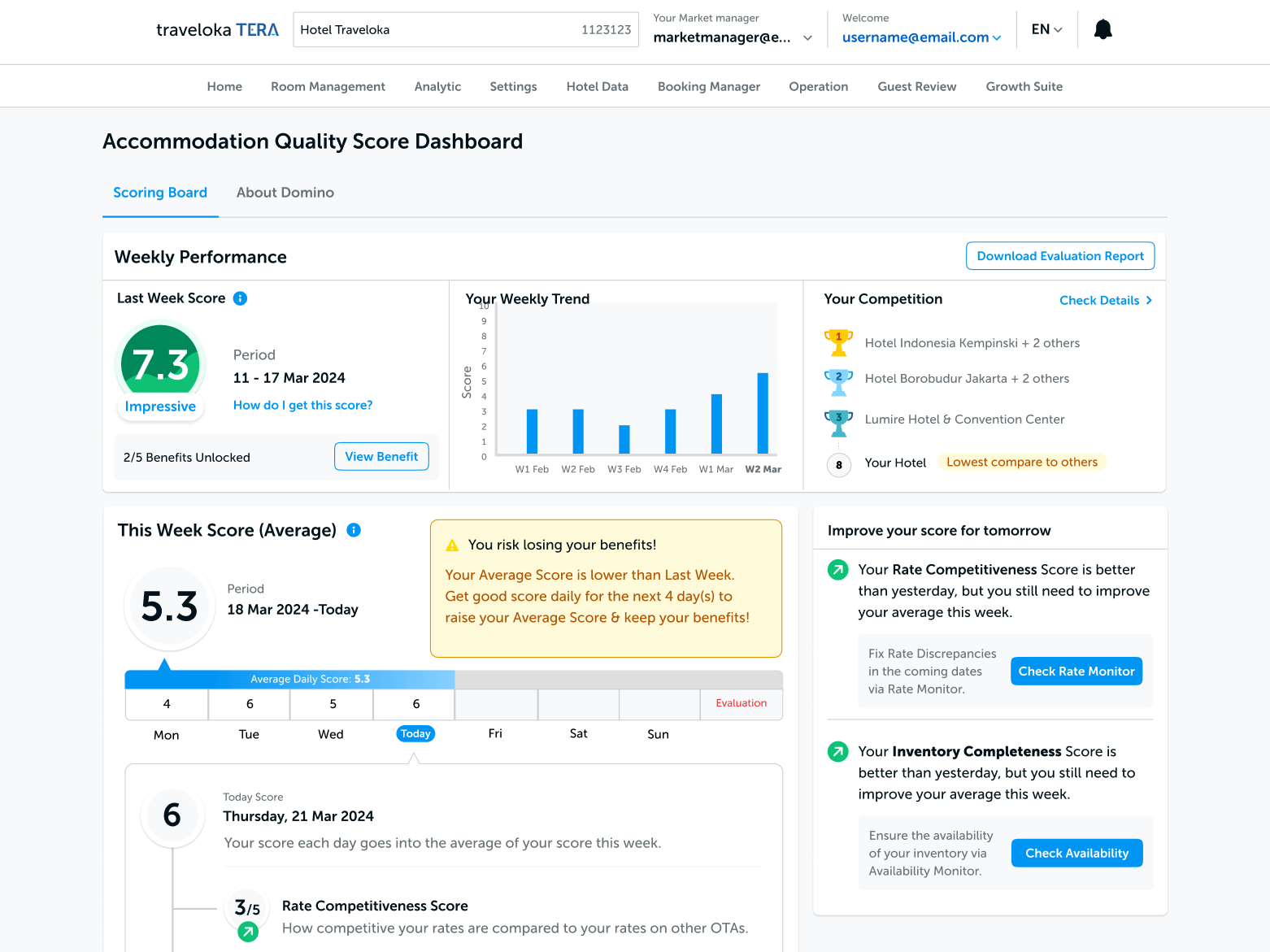

Real-time Order Execution Tracking

OMS integrates notifications, ticket counters and order execution module to provide higher visibility on order progress.

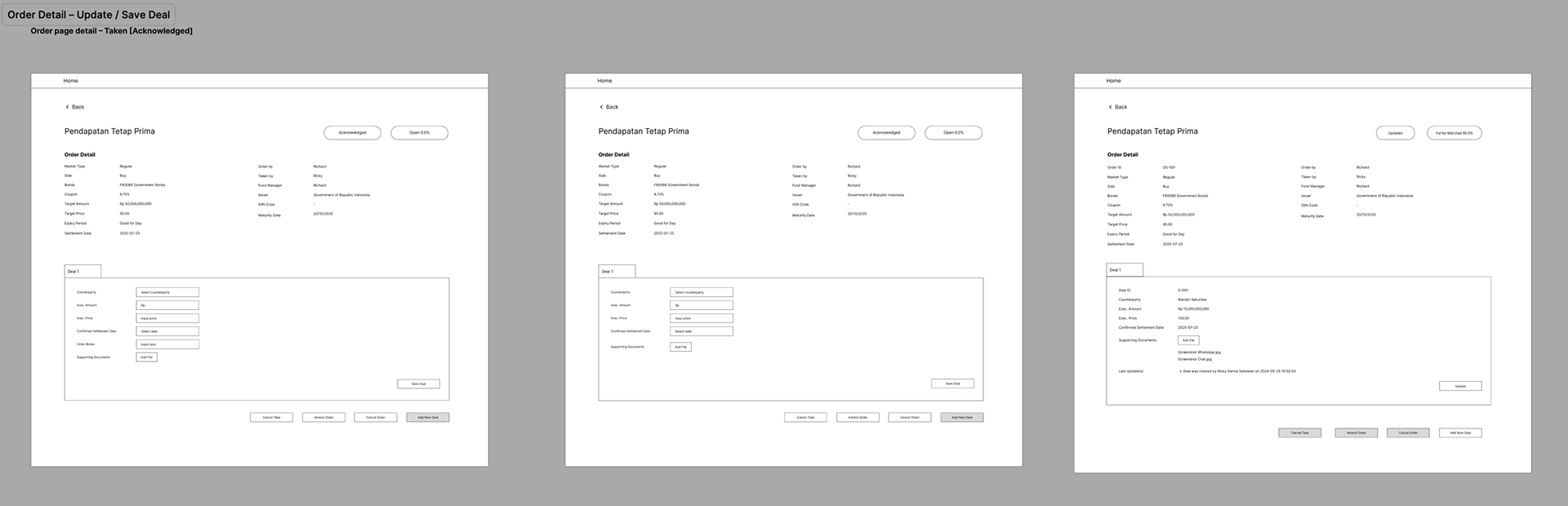

Order Execution Module

Dealers can easily create deal, edit and delete existing deal, and add new ones. This flexibility is necessary to accommodate dealer's workflow:

• Dealer may create multiple deals with different counterparties or same ones in order to fulfill order's target amount

• Deals can only be created after order is taken, because dealer needs to identify the counterparties that offer the best price before negotiating a deal with them

The reasons above become the foundation of the order execution module.

Outcome

This solution impacts the performance and governance of Henan's business operations:

• Simplify reconciliation and reporting: the dashboard streamlines communication across teams, while also providing a more accurate audit trail – reducing manual reconciliation time and error through data consistency.

• Enable data-driven insights: the system provides data points which help the fund manager and dealer teams to measure their performance. This will enable them to create continuous improvement and transparent accountability.

Key Learnings

Challenges faced in this project:

• Deep domain expertise – managing this project proved to be very challenging as it required me to learn financial market and industry regulation quickly. I have to learn their whole ecosystem in order to produce a comprehensive system design that answers every scenario while also improving it in order to meets industry best practice and regulation.

• Complexity in designing a robust, scalable system – as I was also the designer of this project, I had to create a mini design system that allows me to make multiple flows and iteration quickly. This means creating a list of components for each modules and versioning to document their individual states.