Project Context

This project was part of Xendit's initiative in driving their regionalization in Southeast Asia. Our team was consisted of two UX researchers, two product managers and another product designer. I served mainly as the UX strategist, whose task was designing the account structure and account creation flow.

• Role: Design / UX Strategist

• Role: Design / UX Strategist

• Scope: UX strategy, UX research and user flow

• Timeline: 2 months

Background Context

Xendit is a leading fintech company providing payment infrastructure for businesses across Southeast Asia.

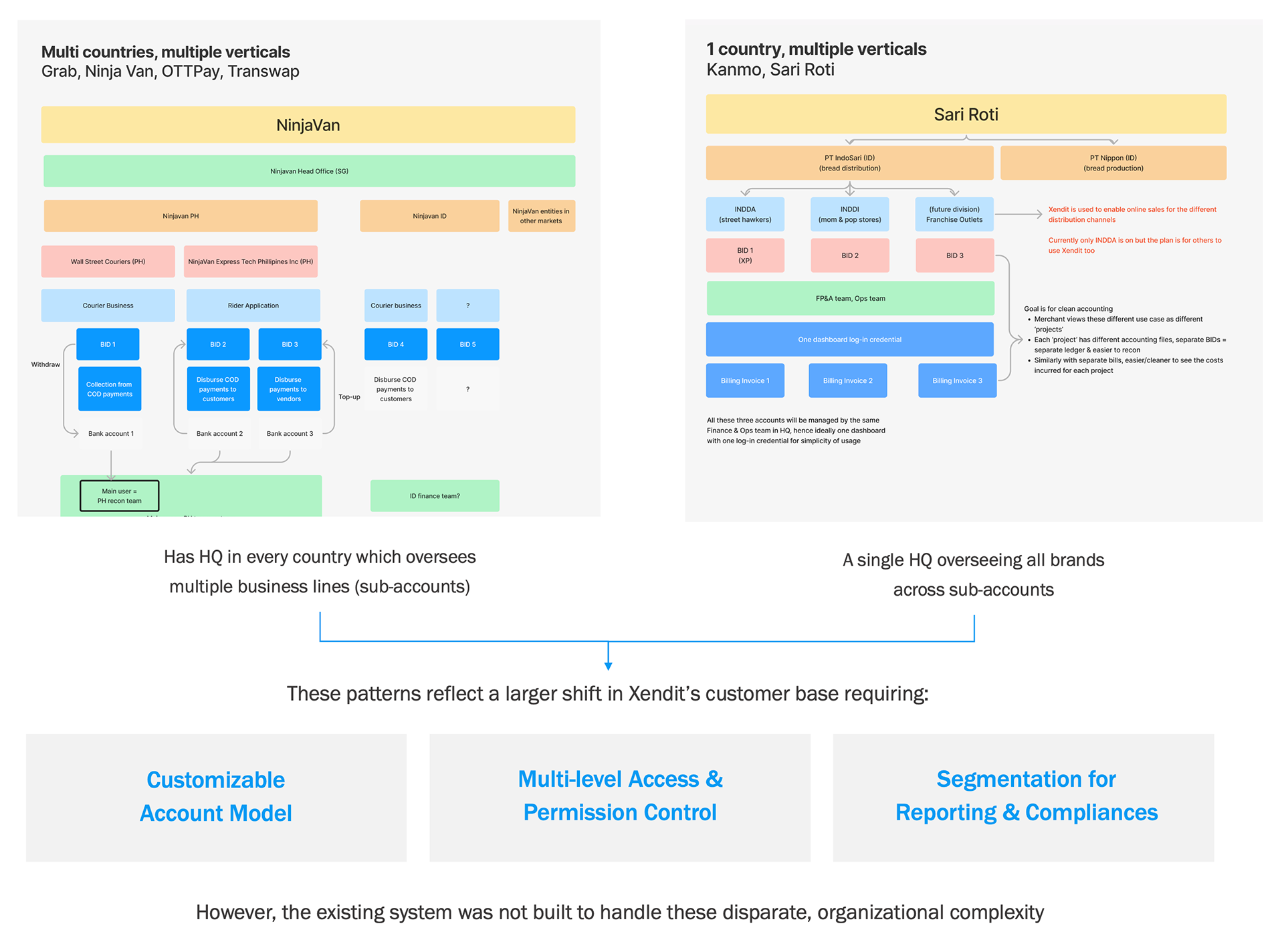

As the company expanded beyond Indonesia into regional markets, it began onboarding enterprise merchants with more sophisticated operational and compliance needs. See the use cases below:

Problems

Goals

Design Process

Research

These insights are derived through previous user research, stakeholder interviews and competitor benchmarking. The outcome of this research process is to shape the account structure, model and principles.

Research Insight – Merchants Behavior

The interviews revealed that each merchant has different approach to how they structure their accounts – depending on their organization maturity, business use case and intention (e.g opening new vertical, regional expansion, etc).

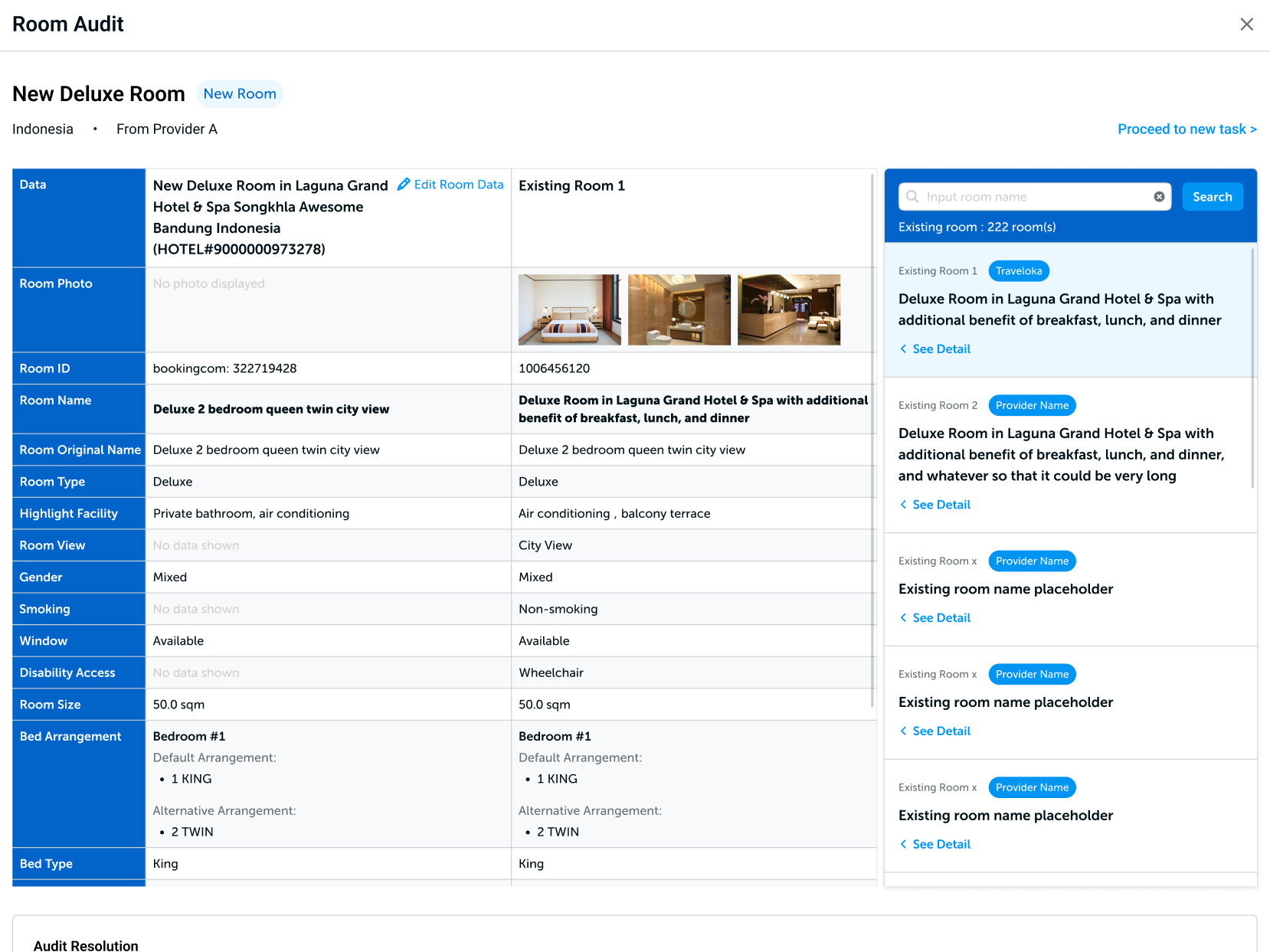

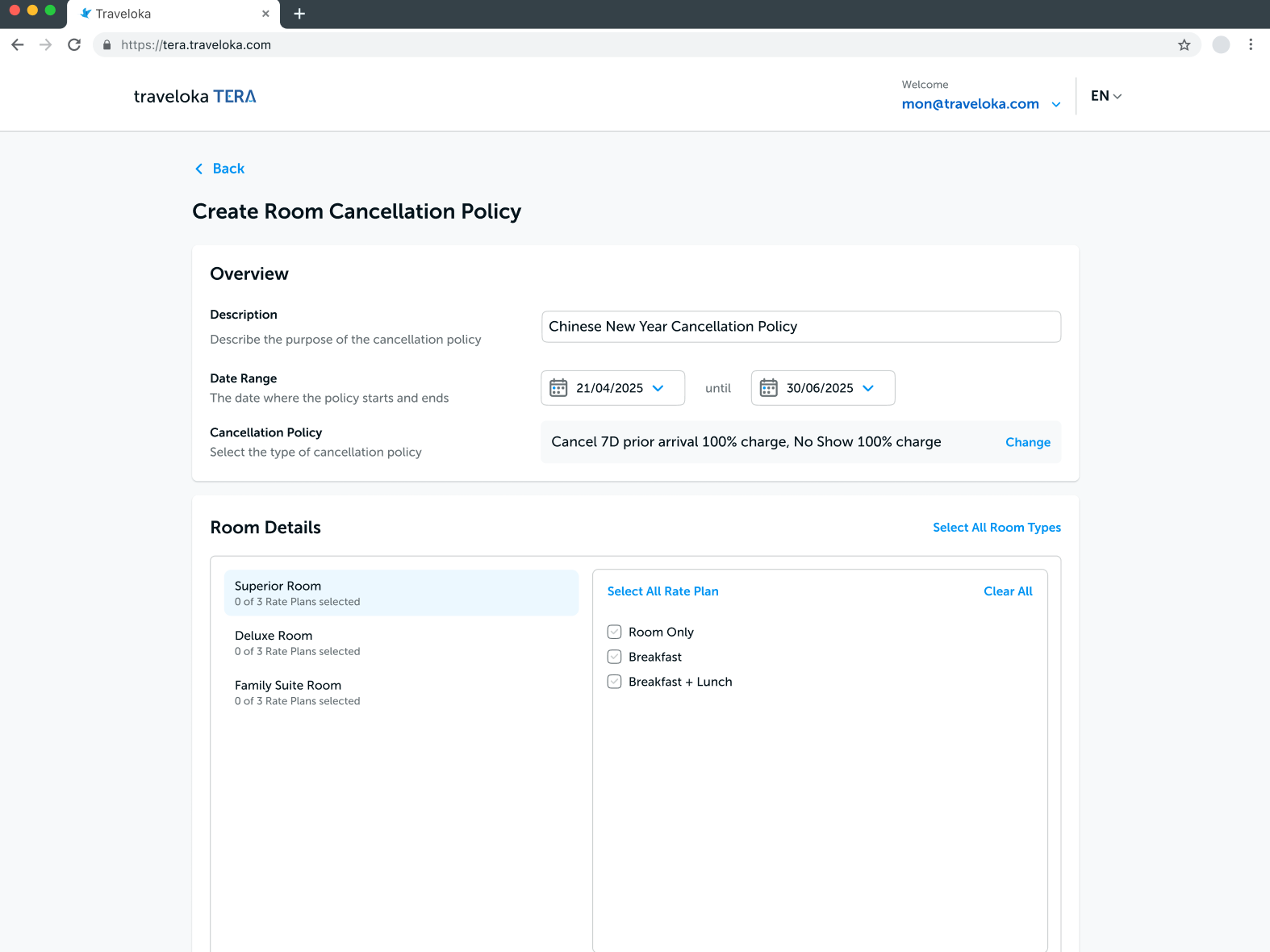

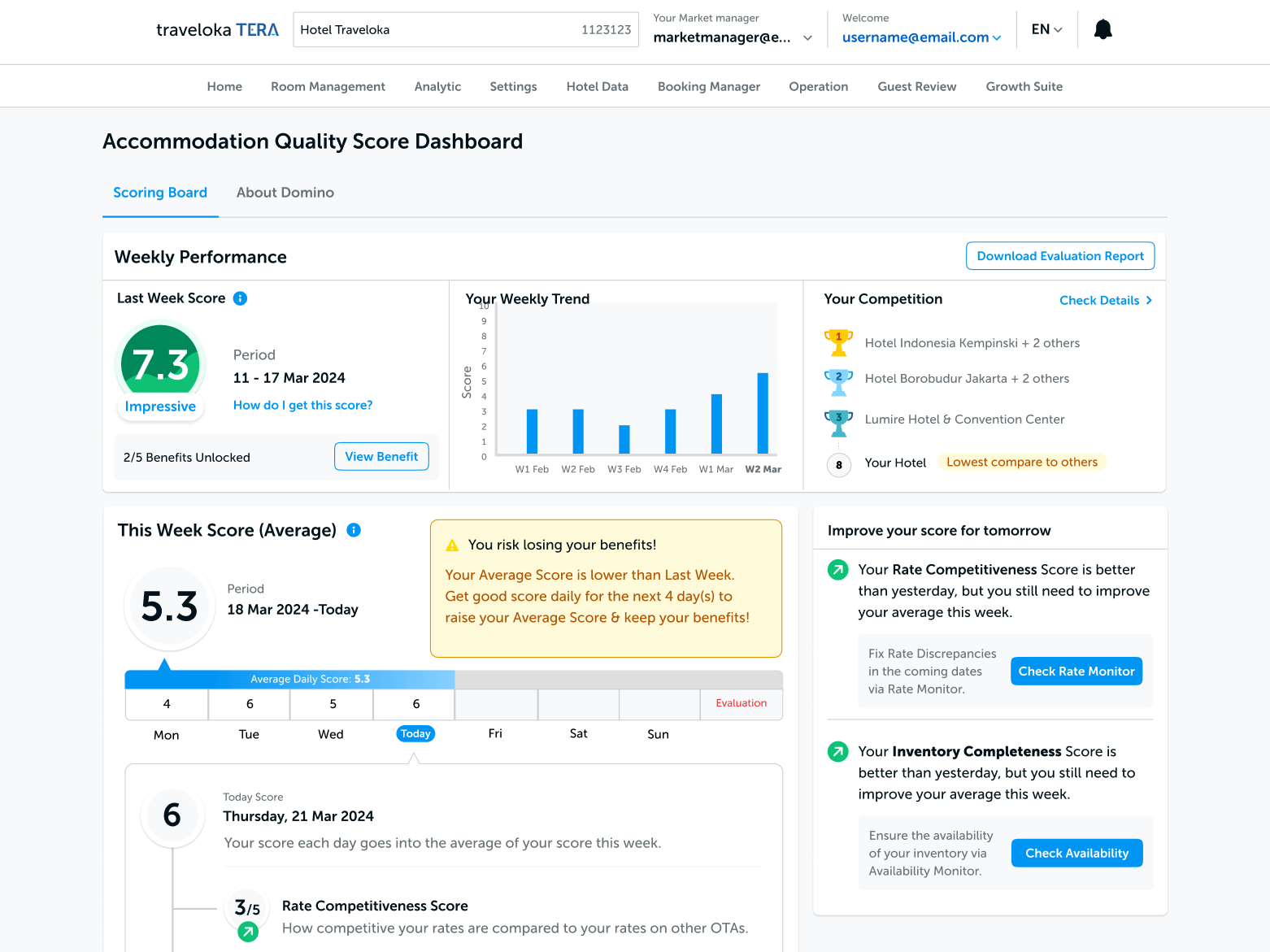

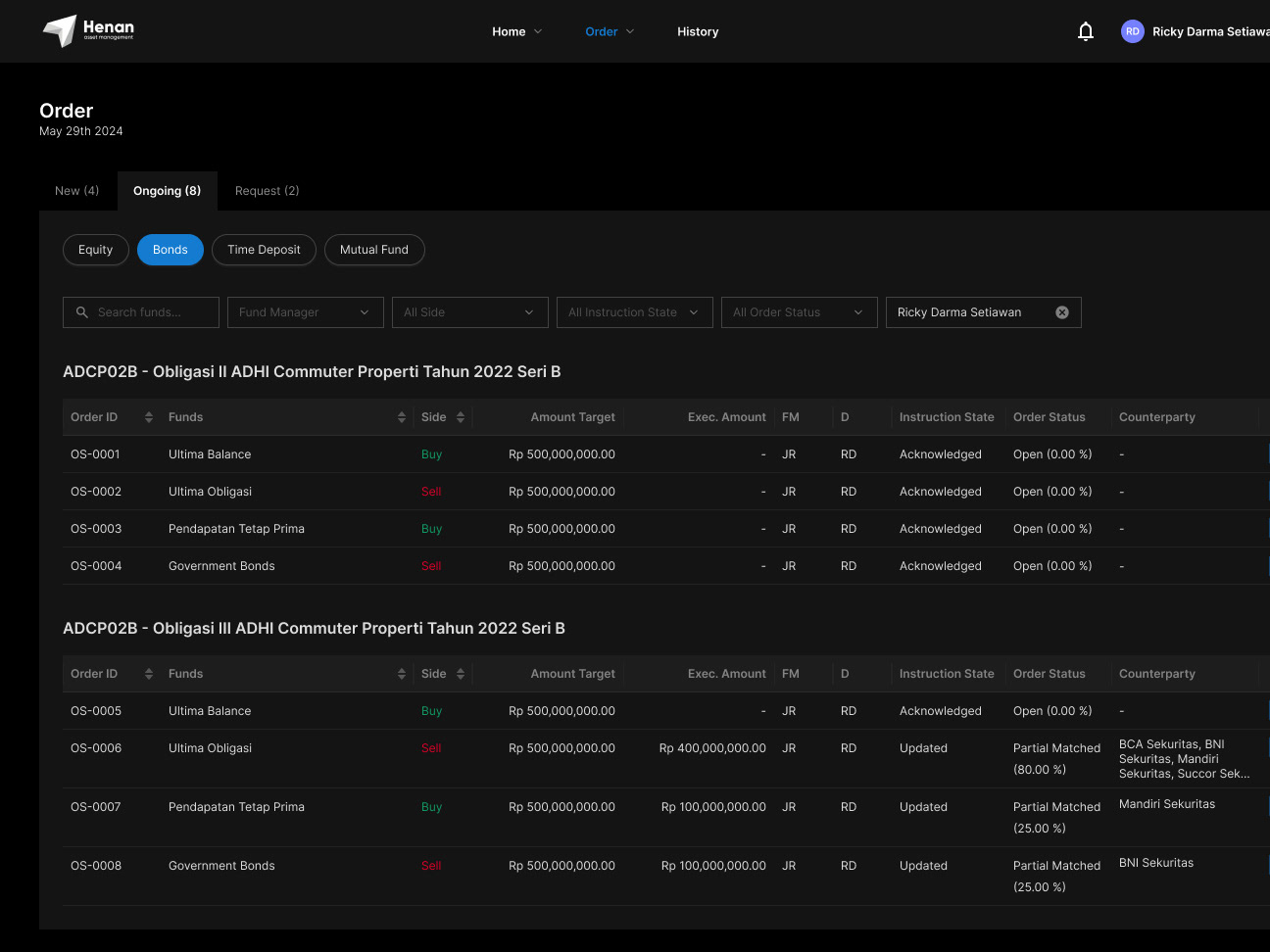

Competitor Benchmarking

I also analyzed the account structure in other global payment gateways to ideate a new account model applicable to Xendit.

Account Model

The research insights above led to the creation of the new account structure below:

For this project, we will be focusing on the account creation process – setting up new business account and company account. The set up for account group, account access configuration and account linkage will be out of scope (next phase).

Account Creation Flow

The new account structure and principles are then integrated into our new account creation flow. Our goal is to create a more streamlined flow that's scalable and is aligned with our compliance requirements.

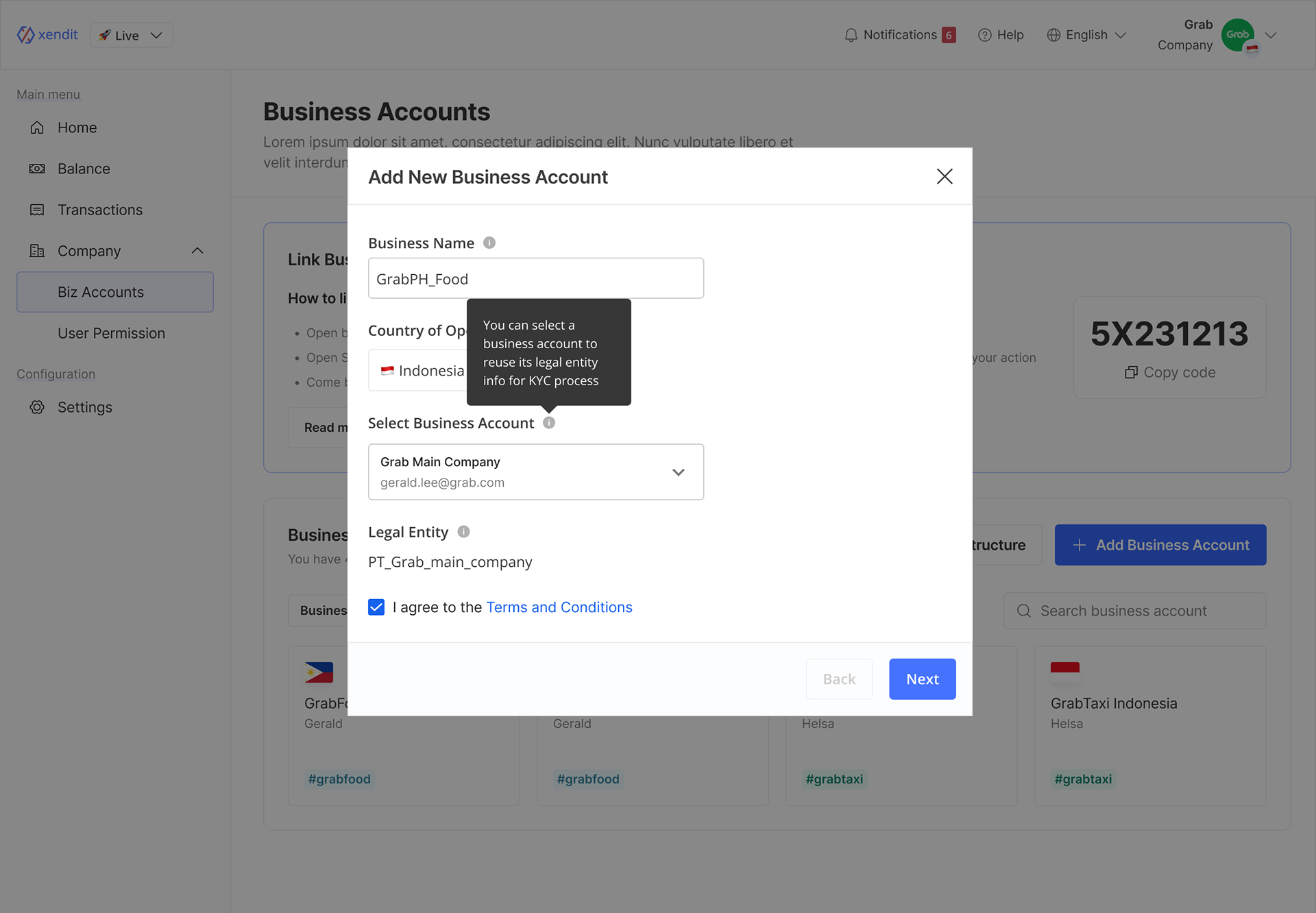

Design an algorithm that determines merchants' KYC reusability based on regulatory requirements

To reduce user steps, I evaluated the necessity of Xendit's questions that affects merchant's eligibility and KYC requirements: purpose of account creation, legal entity, country and industry regulation.

Translate algorithm into user flow

Once the determinant parameters are identified, they are then translated into a proper user flow for Xendit's new pre-lead qualification journey.

Implementation

The new flow is integrated into the existing onboarding flow, while also providing flexible options for system migrations.

Provide flexibility through multiple entry and migration compatibility for new and existing merchants

Existing merchants (embedded and self-serve)

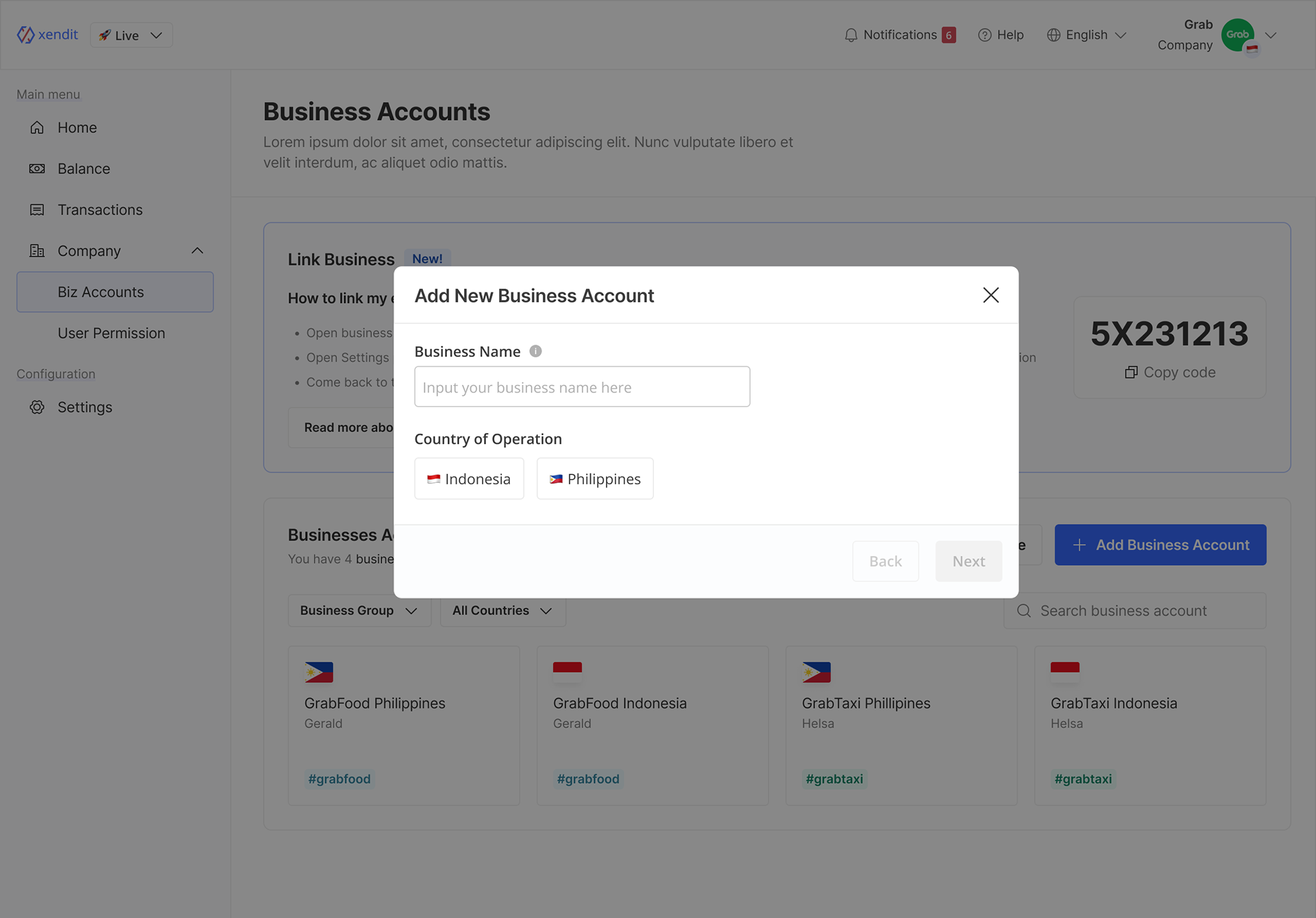

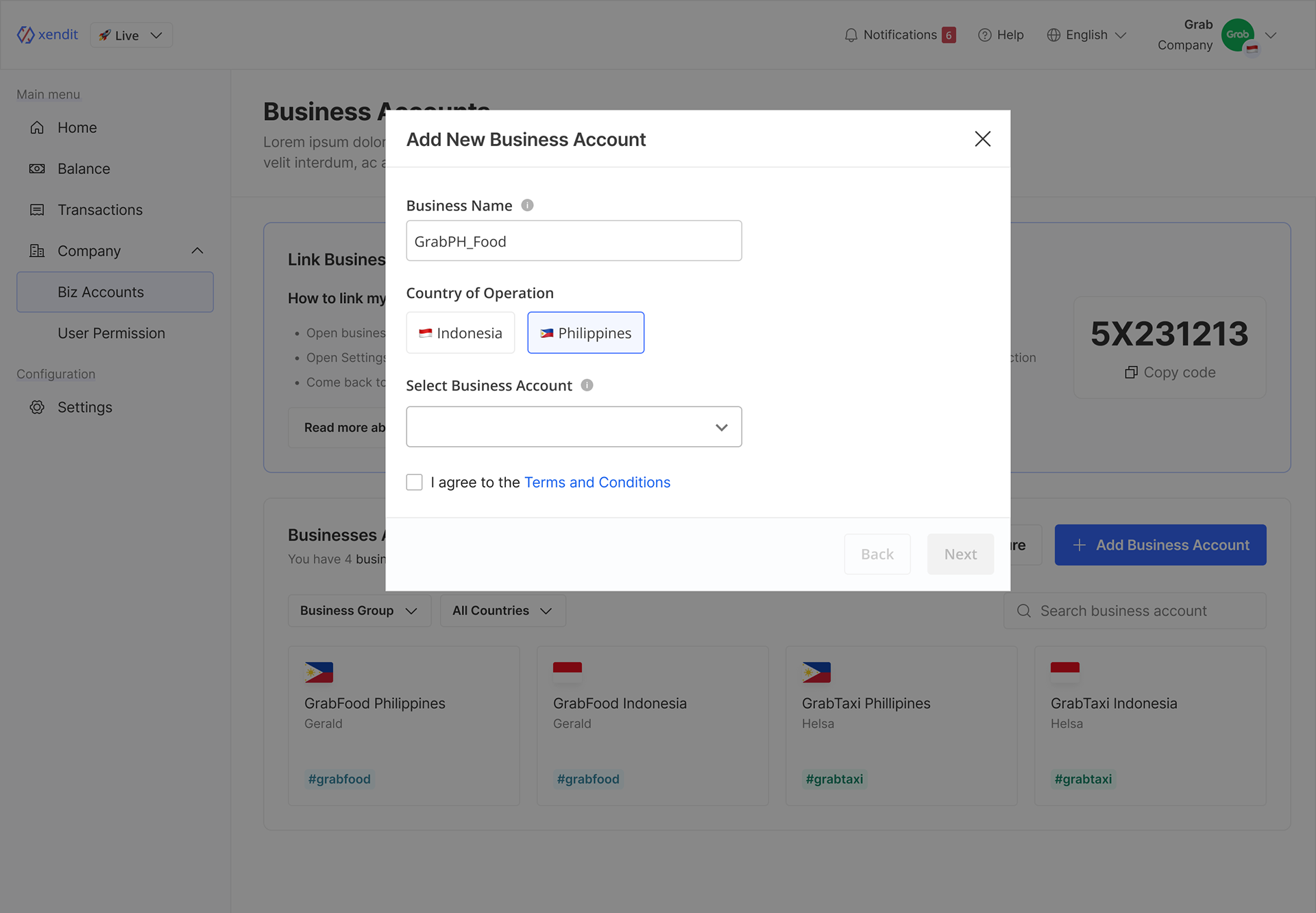

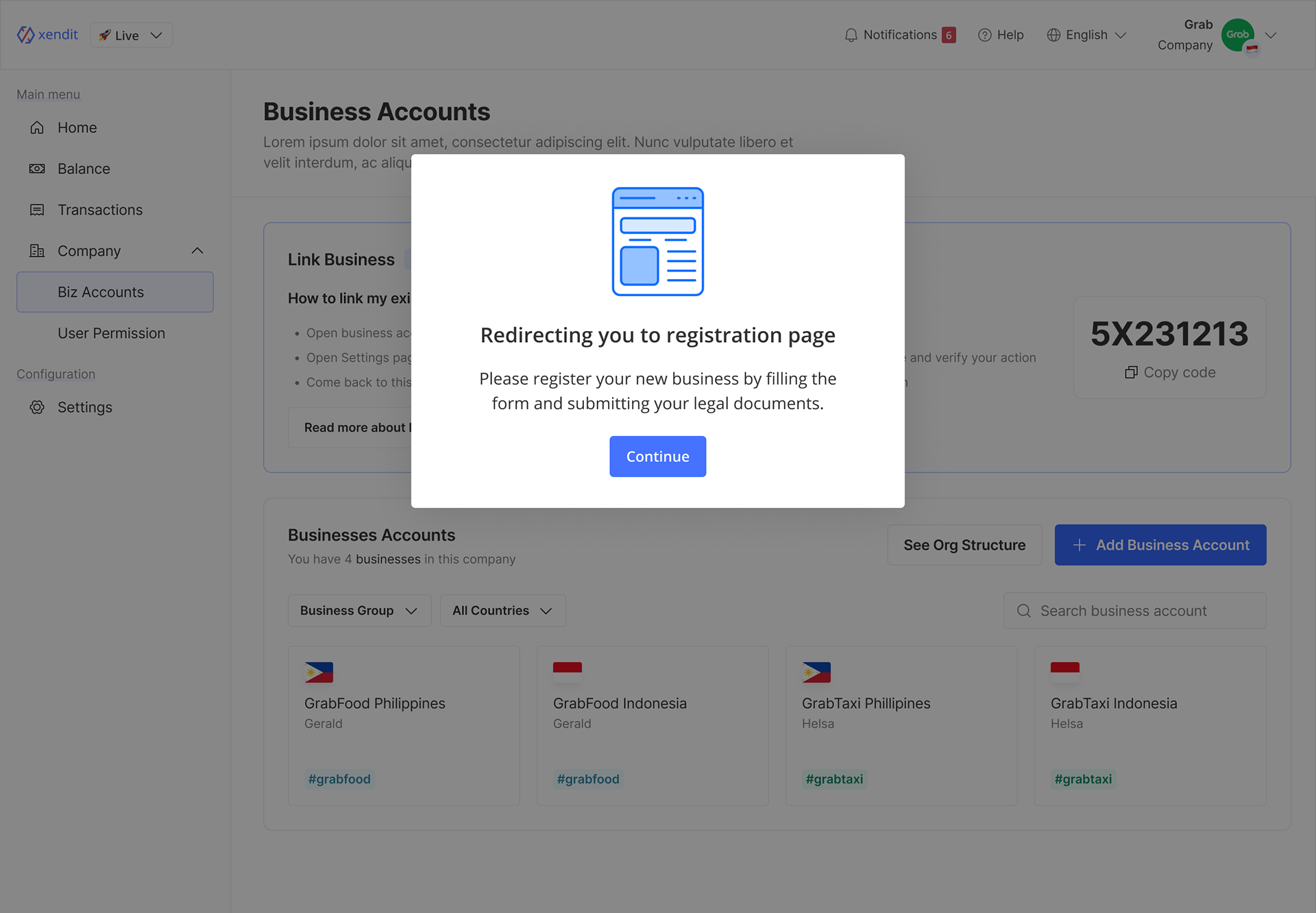

Existing merchants can access the account creation setup from their current account settings and global menu. Once triggered, they can create new business account and setup the company one on their own.

New merchants (direct onboarding through manual method)

New merchants can be onboarded directly to the new company account and business account through manual engineering process. Given that this MVP is still on testing phase, we only offered this to selected merchants that suit our profile criteria.

Streamlining account creation by providing a pre-lead qualification process to determine KYC reusability

The flow is triggered when merchant clicks the CTA button. This prompts a modal where they fill the basic preliminary questions to determine their KYC reusability:

• Legal entity

• Country of operation

• Industry

• Legal entity

• Country of operation

• Industry

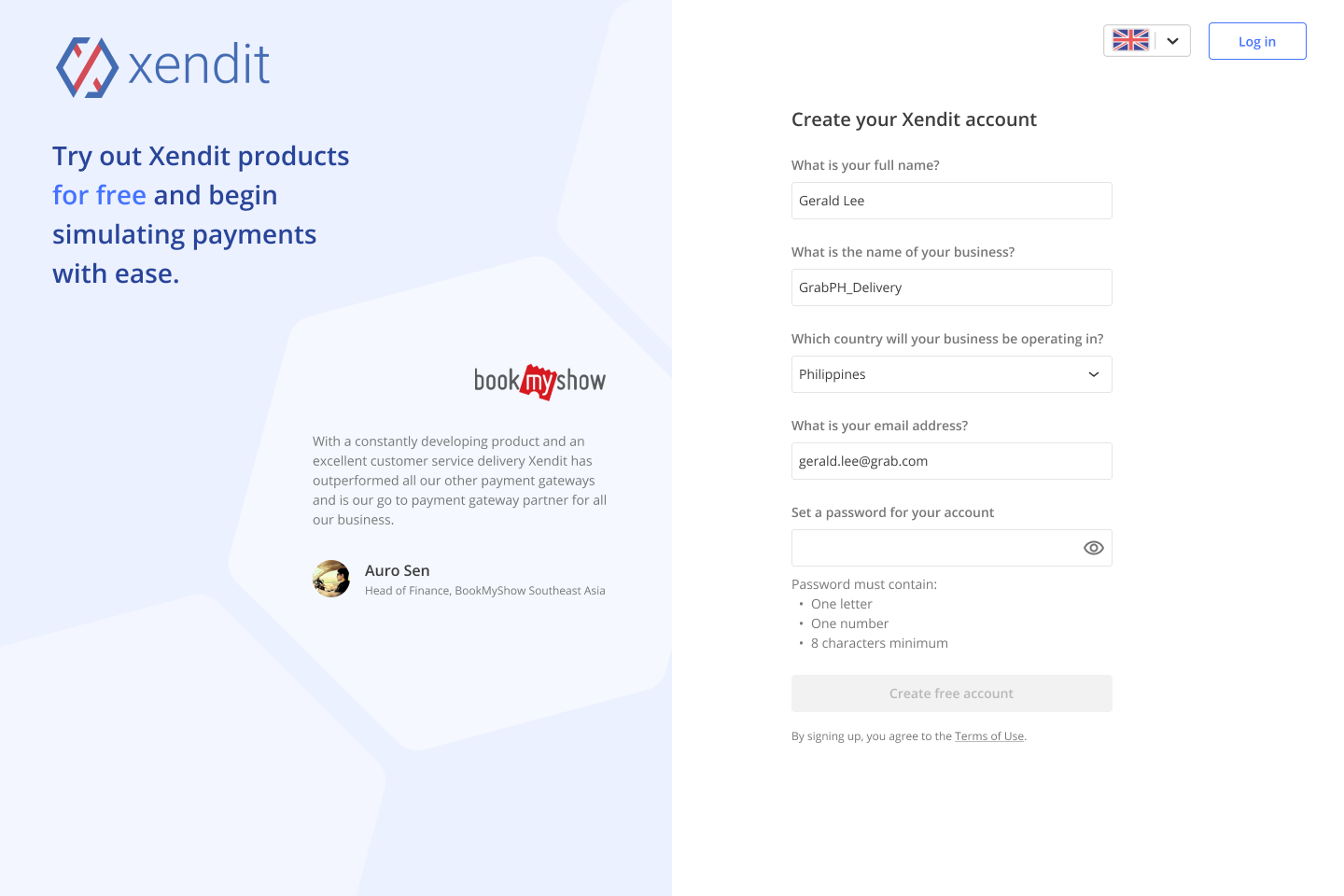

If merchant chooses a legal entity or country of operation that's different from their previous account, then they cannot reuse their data. Merchant will be redirected to the sign up page to sign up a new account from scratch (follow existing process).

If merchant chooses a legal entity of country of operation that is same as their previous account, then they can reuse their data and will be redirected to the onboarding wizard to review and change their previous documents if needed. Once completed, merchant can monitor their account status on their dashboard.

Concept Validation

Before developing this new solution, we presented the new account model and flow to some of our merchants and internal stakeholders (account managers). All of them responded positively and agreed that this will reduce their pain points significantly. Their feedback as followed:

Merchants:

• The new account structure allowed them to manage their accounts more easily, because it provides better visibility and navigation than the previous structure.

• The new flow is also intuitive and more seamless, and the entry point is easier to find (higher discoverability).

• They requested a reporting page on company account that allows them to export reconciliation report from all of the accounts underneath them.

Account Managers

• They appreciated the flexibility of the new account structure – because it can be tailored to any business use case.

• Also liked how the new account creation flow can reduce the amount of KYC data and manual processes needed.

Outcome

This solution made impact on both Xendit's internal operation and business goals:

• Improve operational efficiency: reduced onboarding-related support requests by 20%. Also increased successful account activations through faster setup and improved transparency.

• Support business growth across regions: facilitated smoother cross-regional merchant expansion, enhancing acquisition and retention.

Key Learnings

Challenges faced in this project:

• Streamlining the research synthesis and brainstorming process – the ideation process took much longer because there were some vital information missed out during our research process. However we managed to solved this by validating our assumptions first with our internal teams.

• Alignment with other teams – as the scope of this project overlapped with other product team's areas (Onboarding), we had to scheduled regular cadence in order to align our directions. While it slowed down our progress a bit, but this is necessary to ensure our vision would be executed holistically.